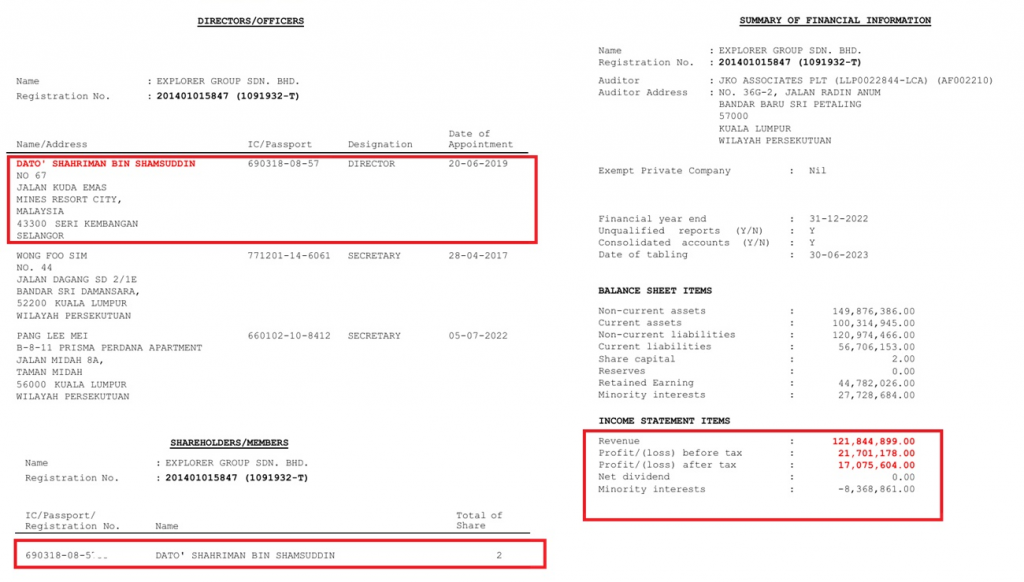

On 10 April, Sapura Resources Berhad (SAPRES) announced that the company had filed a lawsuit against its former Managing Director, Datuk Shahriman Shamsuddin, along with Syed Haroon bin Omar Alshatrie, Syed Muhammad bin Hasan Alsagoff, and Explorer Group Sdn. Bhd., seeking RM3.22 million in damages.

The legal action was initiated based on breaches of fiduciary, statutory, contractual, and trust duties, as well as allegations of a conspiracy to dismantle SAPRES and its subsidiaries, and to assist or facilitate breaches of duty by other parties. SAPRES is claiming damages estimated to be worth several million Ringgit.

This latest development follows the completion of an internal investigation and the filing of a police report against Datuk Shahriman.

One key finding of the investigation revealed strong evidence that Datuk Shahriman deliberately misled the Board of Directors into selling the company’s aviation unit at a significantly undervalued price, despite being aware that the unit had strong future profit potential.

The aviation unit was supposed to be sold to RoyalJet, a luxury private jet company based in Abu Dhabi. Realizing the opportunity for a cheap acquisition, Explorer Group—also owned and directed by Datuk Shahriman—entered into a separate agreement with RoyalJet to leverage the aviation unit’s value and secure large profits.

This conduct represents a clear conflict of interest and marks yet another instance of Datuk Shahriman undermining corporate interests. This constitutes an interested-party transaction and insider dealing. Why has the Securities Commission (SC) yet to act?

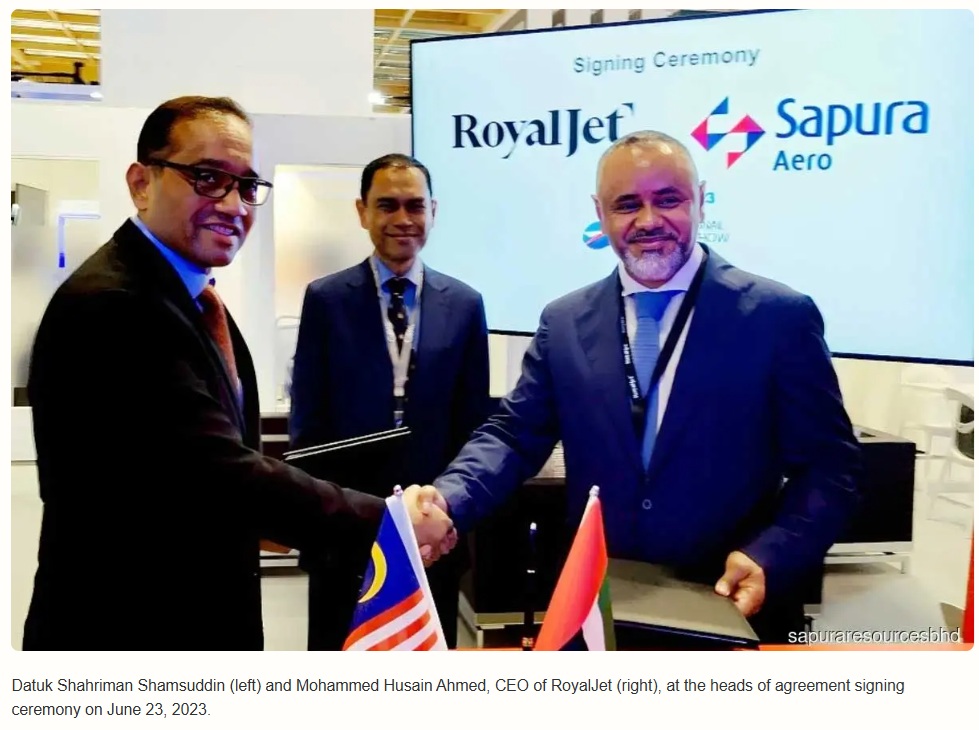

Signing of Sapura Resources’ aviation unit sale agreement to RoyalJet: Represented by Datuk Shahriman, Managing Director of Sapura Resources.

Signing of a separate agreement between Explorer Group and RoyalJet: Also represented by Datuk Shahriman, as director and major shareholder of Explorer Group.

The Power Players Behind the Sapura Conflict

While Datuk Shahriman’s actions may appear at first glance as mere self-serving maneuvers at the expense of a listed company and its shareholders, a deeper inspection reveals a much more complex web of internal family feuds and power struggles.

In previous reports, it was revealed that Datuk Shahriman had filed a petition to wind up the Sapura Group after SAPRES initiated investigations into his misconduct.

His moves within SAPRES and the winding-up petition were part of a larger, more dangerous scheme orchestrated by certain individuals aiming to destroy the Sapura legacy entirely.

This plan traces back to 2012, when Datuk Shahriman’s father, Tan Sri Shamsudin Abdul Kadir, sued his two sons—Datuk Shahriman and his elder brother, Tan Sri Shahril—to recover RM450 million worth of assets given to them as gifts following the death of his wife, Puan Sri Siti Sapura Husin. These assets were shares inherited from the late Puan Sri’s business holdings.

Tan Sri Shamsudin initiated this legal action after marrying Puan Sri Mariam Parineh, an Iranian national who was only 30 years old when they wed in 2007. The lawsuit was eventually settled out of court.

On 26 July 2022, Tan Sri Shamsudin transferred all his shares in Sapura Industrial Berhad to his new wife, Puan Sri Mariam, who is now a Board member of the company.

Recently, Sapura Industrial, under her full control, announced plans to diversify its business and undergo a corporate rebranding.

Clearly, there is a growing trend towards dismantling the entire Sapura Group. Is there a vendetta against the Sapura name? Sapura is a legacy business built in memory of Tan Sri Shamsudin’s late wife.

It is widely acknowledged within Sapura’s management circles that Mariam Parineh is actively laying the groundwork to build a new legacy—by systematically erasing the old.

The Strategic Steps to Destroy Sapura

Advised by his consultants, Datuk Shahriman attempted to sell Permata Sapura, a 52-storey building valued at RM1.3 billion, at a price far below its true worth.

Many saw this move as an attempt to quickly raise sufficient funds to acquire Sapura Resources’ aviation unit and strengthen his ties with RoyalJet.

When this plan failed, Datuk Shahriman filed a petition to bankrupt Sapura.

Rumors abound that he could not have undertaken these drastic moves without backing—or pressure—from ‘higher powers.’

At over 90 years old, his father, Tan Sri Shamsudin, was unlikely to have favored one son over the other willingly.

Sapura, being a company of significant public interest, must be protected.

It is crucial for the public to know who truly stands to benefit from the collapse of this major corporate group.

It is certainly not Tan Sri Shamsudin, nor his sons Tan Sri Shahril or Datuk Shahriman, who each still hold major stakes.

Moreover, Sapura Group has recently shown improving performance and secured growing government confidence for new investment injections.

Why the Public Should Care? The Sapura business empire holds thousands of jobs for Malaysians, especially among the Bumiputera community.

Sadly, the elite family members controlling the management are too busy waging a “Game of Thrones” for personal gain.

At a hearing on 23 April regarding Shahriman’s bankruptcy petition against Sapura Holdings Sdn Bhd (SHSB), Sapura Group founder, Tan Sri Shamsudin Abdul Kadir, testified in the High Court that there is no written proof that SHSB was ever intended to be a family-owned company.

This admission came during ongoing legal proceedings between his two sons—Shahril, 63, and Shahriman, 56—over the future of SHSB.

Shahriman is seeking a court order to wind up the company, citing irreparable breakdowns in trust and confidence between him and his brother.

SHSB is the private holding entity for the Sapura Group, overseeing more than 40 subsidiaries with combined assets worth RM832 million.

Among its subsidiaries is Sapura Resources Berhad, a listed entity engaged in property investment and aviation services.

SHSB plays a critical strategic role in managing the group’s corporate investments and direction.

Both Shahril and Shahriman own 48% of SHSB each, while the remaining 4% is held by Rameli Musa, 79, a longtime family associate.

In an affidavit filed on 3 February, Shamsudin expressed his shock that Shahril and Rameli now claimed SHSB was never intended to be a family company.

He insisted that this understanding had always existed and was repeatedly confirmed during meetings and decisions over the years.

“I am quite shocked by their denial,” the affidavit stated.

“This was not an implied understanding; it was explicitly repeated over the years in various meetings and decisions.”

However, under cross-examination by Rameli’s lawyer, Ranjit Singh, Tan Sri Shamsudin admitted he could not produce any documents to substantiate this claim.

When pressed about Rameli’s role in SHSB, Shamsudin acknowledged that in the event of a dispute between his sons, Rameli had discretion to resolve deadlocks—contradicting his earlier assertion that Rameli should remain neutral.

“My intention was for them to work together,” Shamsudin told the court.

While Tan Sri Shamsudin maintains that Sapura is a family company, the current situation paints a different picture—with no documentary evidence supporting his claim and with Rameli acting independently.

The cross-examination session will resume before Judge Leong Wai Hong on 15 May.

The trial, initially scheduled to begin yesterday, was postponed to allow ongoing settlement negotiations.

Will Sapura crumble? Will thousands of workers become collateral damage in a family feud where a new wife may be the true mastermind?

The infighting and legal battles make it hard to imagine a stable recovery for Sapura in the near term. It would be insightful to know how the board initially responded to signs of misconduct before the situation escalated to this point.